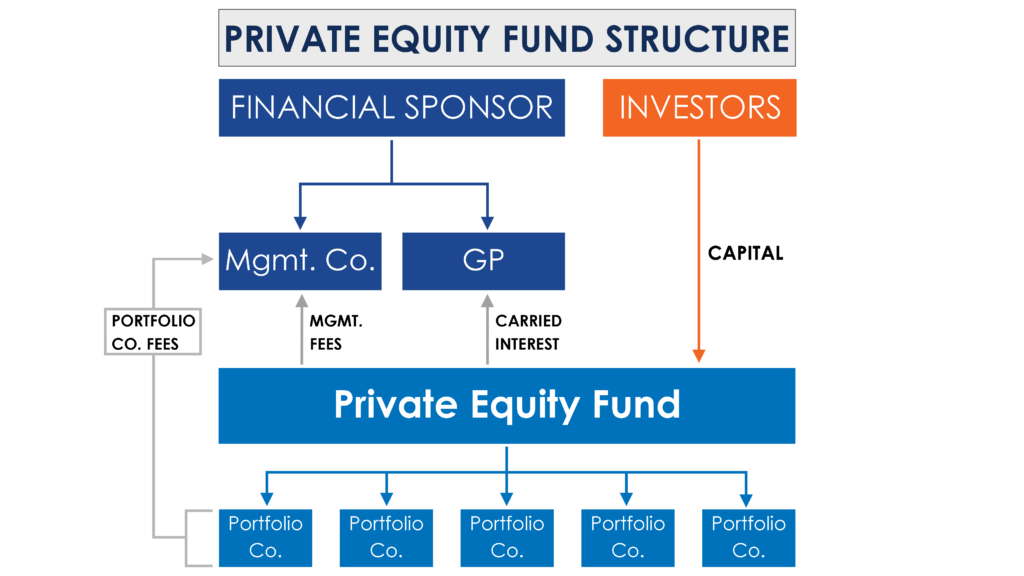

A Fund entity to invest in one or multiple portfolio companies / funds / assets, often structured as an Limited Partnership (LP) or an LLC.

A GP entity to contribute a GP commitment to the Fund entity and to receive the carried interest, often structured as an LLC.

A Management Co. entity to receive the management fee to pay for the funds operating expenses (salaries, rent, travel, fund admin, etc.), often structured as an LLC.

An Advisory entity (Optional) for receiving compensation for working with portfolio companies and other companies, often structured as an LLC.

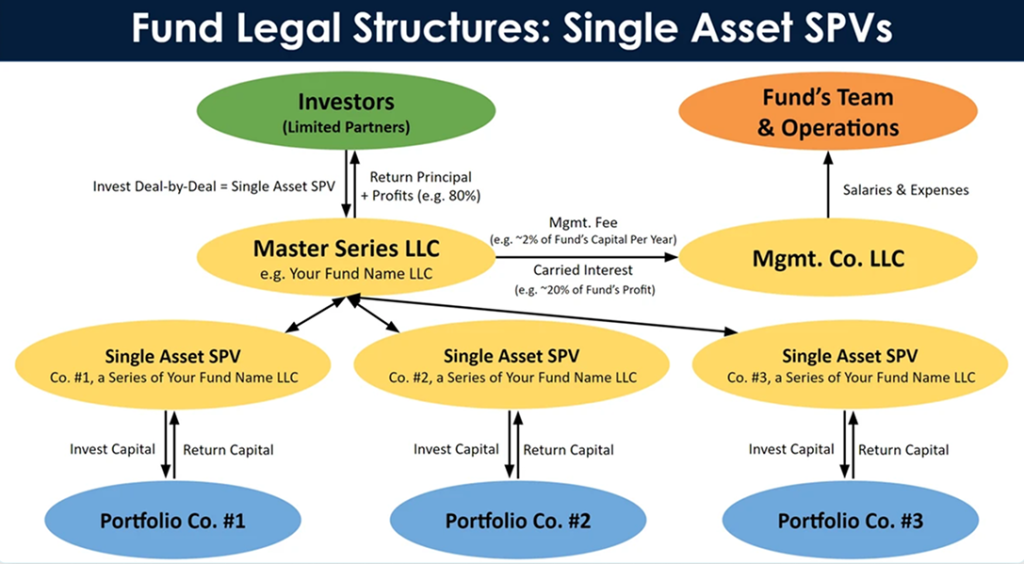

Multi-Asset SPVs: You can also create a fund structure using a multi-asset SPV under a Master LLC using a custom named Master LLC or using Finally’s Master Fund LLC called “Master Fund I LLC”. You don’t technically need a GP entity and Management Co. entity with a multi-asset SPV structure, which saves on legal entity costs, though they do come in handy for organizing the payment and distribution of cash flows from management fees and carried interest. You can use legal entities you’ve created in the past as the GP entity and/or Management entity or create a new GP entity and/or a new Management Co. entity.

Multi-Assets Entities (Either traditional Funds or Multi-Asset SPVs): You would use this structure if your investors are going to be equally invested across all portfolio assets based on their percent of committed capital in the fund. Typically capital calls with happen 1-2 times a year over the fund’s investment period (the time to build the portfolio, ~2-5 years) and may have 0%-66% in reserve capital for making follow-on investments where you invest additional capital into select portfolio companies. A fund is usually raised within 3-18 months, with one or multiple closings, and investors in the fund have a pro-rata share of the funds profits and losses, such that an LP with $10M in capital of a $100M fund has 10% of value of each asset within the portfolio.

A traditional fund model and a multi-asset SPV structure also benefits from cost savings of having multiple investments within the fund entity or multi-asset SPV entity, rather than having a seperate LLC for each investment, which would have a annual legal maintenance fee per LLC.

The final structure of your fund, including the details of the management fee and the carried interest, can be customized within your fund documents. A multi-asset fund or SPV can be used for a venture capital fund investing in a portfolio of early stage companies, a private equity fund investing in a portfolio of real estate properties, growth equity companies, and pre-IPO companies, as well as for investing as a Fund-of-Funds investing in a portfolio of funds.

These are core terms related to investment vehicles, particularly in private equity, venture capital, and real estate investment.

Here’s a breakdown of each:

1. SPV (Special Purpose Vehicle)

- Definition: An SPV is a legal entity created for a specific, limited purpose. It’s typically used to isolate financial risk or to manage assets in a way that separates them from the parent company’s balance sheet. SPVs are often used in structured finance, mergers and acquisitions, and investments.

- Purpose: The key goal of an SPV is to isolate risk. For example, in real estate investment, an SPV may be created to purchase and manage a specific property, so the liabilities and risks associated with that property do not affect the parent company’s other assets or investments.

- Common Use Cases:

- Real Estate Investment: Creating a separate entity to hold a specific property or set of properties.

- Project Financing: Using an SPV to finance a particular project without involving the parent company’s other assets.

- Risk Isolation: In structured finance, SPVs can be used to isolate risk from the main business operations.

2. Multi-Asset SPV

- Definition: A Multi-Asset SPV is a type of SPV that holds a diverse range of assets rather than just one. These assets could include a mix of real estate, securities, loans, or other types of investments.

- Purpose: The goal is to manage different types of assets under one entity, which could allow.

- Project or Investment Funds: Used by fund managers to structure investments in multiple types of assets for clients.

3. Committed Capital Fund

- Definition: A Committed Capital Fund is an investment fund where investors commit a certain amount of capital to be invested over time. The capital is typically called as needed for investments, and investors cannot withdraw their commitment early unless specific conditions are met.

- Purpose: The capital is “committed” for a specific purpose, such as private equity, venture capital, or real estate investments. The fund manager can then draw down the committed capital when opportunities arise to make investments.

- Common Use Cases:

- Private Equity and Venture Capital Funds: Investors agree to commit capital, which the fund manager can call upon as deals or investment opportunities arise.

- Real Estate Development: A fund might commit capital to a series of real estate developments, and the capital would be deployed as projects begin.

4. Evergreen Fund

- Definition: An Evergreen Fund is an investment fund that does not have a fixed end date and is designed to be self-sustaining over time. Unlike traditional funds with a set lifespan (e.g., 7–10 years), evergreen funds continuously raise capital, make investments, and return capital to investors as it is realized.

- Purpose: The goal of an evergreen fund is to provide long-term growth and liquidity by continually investing, realizing returns, and reinvesting those returns, creating a perpetual cycle of capital generation.

- Common Use Cases:

- Private Equity or Venture Capital: For firms looking to maintain a continuous pool of capital and invest in long-term growth companies without the need to wind down the fund.

- Real Estate Investment: An evergreen fund might continually buy, manage, and sell real estate properties, providing regular returns to investors while keeping the fund active indefinitely.

- Key Feature: The primary difference between an evergreen fund and traditional funds is the lack of a defined exit date, allowing the fund to operate on an ongoing basis.

Summary of Key Differences:

- SPV: A legal entity created for a specific purpose or asset.

- Multi-Asset SPV: An SPV holding a variety of different types of assets, providing diversification.

- Committed Capital Fund: A fund where investors commit capital that is drawn down over time for investments.

- Evergreen Fund: A fund without a fixed termination date, allowing for continuous investment and reinvestment of capital.

Each of these investment vehicles serves a different purpose depending on the investor’s objectives, the risk profile, and the type of assets being managed.

• Caution #1: Pre-Paying For Multiple Years For Service: The investment admin industry has felt the negative effects of pre-paying for multiple years for investment admin services that were then never delivered because either the portfolio company had an early exit, was wound down, or the investment administrator went out of business. With Finally you will only pay for the services you receive with our annual pricing model.

• Caution #2: Going After The Lowest Price

If you are searching for the lowest price in the investment admin industry and you find a lower cost service provider than Finally, it will only be because:

The service provider does not provide all of the investment admin services that you will still need to pay for, so in the end the price will be the same once included.

The service provider is not including all of your costs in their price quote, as they will segment out “other costs”, often with a “*” or as a small footnote, to appear cheaper, but once you include all of the costs that you will have you will find that the total cost to be the same or higher compared to Finally. The service provider has an unsustainable business model and they will eventually provide terrible service and go out of business unless they continue burn venture capital dollars to keep themselves alive. You will then have to spend additional time and money to transfer to a new investment administrator in the future once you become so annoyed that they don’t effecticely deliver their services or after they go out of business.

The service provider only provides a technology investor portal platform, and does not provide investment admin services. Having an Investor Portal is only one small part of doing investment administration, and in fact in you can investment administration without an investor portal. The vast majority of investment administration is human services oriented, so either you will have to do it yourself (which is complicated, not fun, and time consuming) or have a service provider like Finally do it for you. Investor portals are just investor portals and they don’t actually do the investment administration that is needed to be done. They don’t provide a dedicated client manager which is necessary for managing the creation of legal entities, creating SPV/fund docs, tracking and signing subscription docs, wires to/from investors and portfolio companies, maintaining bookkeeping/reconsiliation, accounting, getting K1s done on time, and responding to admin requests from your investors.

• Caution #3: Banking

Some investment admin service providers don’t provide a direct relationship to your banking provider, leaving many fund managers and companies unable to access or control their bank accounts. This is especially challenging and freustrating if your investment administrator goes out of business.

• Caution #4: Tax & Accounting

As fund manager ourselves we have had previous painful experiences using other investment admin service providers which is why created Finally. Tax and Accounting is where most investment admins dropped the ball. We created Finally by identifying these core challenges that other service providers had and decided to create a new solution for the investment admin industry.

Scale: The service provider did not have a scalable solution for providing tax and accounting services because they used a small in-house tax/accounting team. While the number of customers grew, the internal tax/accounting team never scaled, and as a result the delivery of services became weak, late, or non-existent. Finally has designed a scalable business model that scales with customer growth and uses an expert U.S. based tax/accounting partner.

Communication: As a client you were unable to speak with the specific person who did your tax/accounting. With Finally, you can speak with the specific person that did your tax/accounting.

Late K1s: The biggest reason for K1s being late is that information was not collected in advance and all of the work was being done during tax season. Finally has developed an innovative process to ensure all information is collected and tracked in advance to provide a more seamless K1s processing experience.