Multi-Asset SPVs & LP Funds: Structures, Services, & Pricing

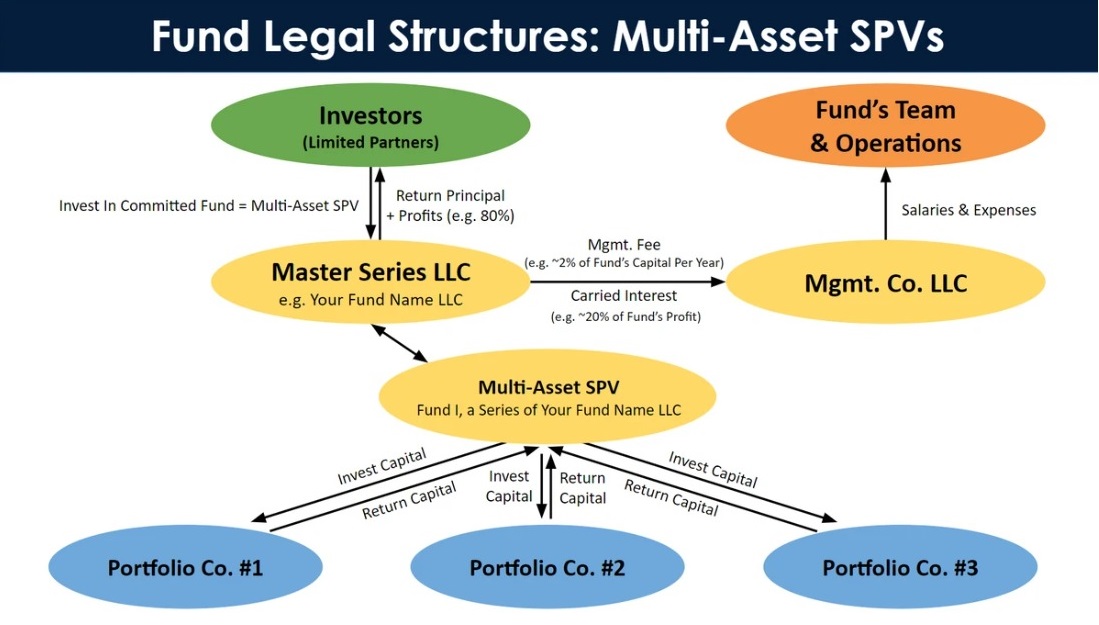

Finally is a full-service fund administration platform where Fund Managers can create a Master Series LLC (a Fund Entity) and have one or multiple Multi-Asset SPVs underneath the Master Series LLC. Each Multi Asset SPV can invest into an opportunity such as a company, a fund, or a real estate

Fund Managers can also use Finally to create LP fund entities to invest into multiple opportunities.

Note: Fund Managers can also create one or multiple single-asset SPVs under a Master Series LLC.

Click here to learn more about single-asset and funds

to discuss with Finally’s team what type of fund structure you would like to create and we can provide a custom quote for you.

There Are Many Benefits To Using A Master Series LLC To Create One Or Multiple Multi-Asset SPVs, Or Using A LP Fund Entity, To Invest Into Multiple Opportunities

Invest In One Or Multiple Opportunties

A Master Series LLC can have one or multiple multi-asset SPVs and one or multiple single-asset SPVs underneath it. Think of the Master Series LLC as your parent fund entity, under which you can have multiple multi-asset SPVs (e.g. Fund I, Fund II, Fund III, etc.) as well as multiple single-asset SPVs (e.g. investments into specific startups, real estate opportunities, or target funds). A LP Fund entity similarly provides a fund structure to invest into one or multiple opportunities.

Offer Your Investors Diversification

A multi-asset SPV and a LP fund entity both provide a fund manager’s investors the benefit of diversification (vs. Single-Asset SPVs) and the investors don’t have to select which investments to make (vs. having discretion of choice with single-Asset SPVs) as the fund manager selects which opportunities to include in the portfolio and how much to invest in each opportunity. Investors in a multi-asset SPV or a LP fund entity have a percent ownership of the multi-asset SPV or LP fund entity. Example: $1M (Individual investor’s investment) of a $100M fund (total capital committed to a multi-asset SPV or LP fund entity by all investors) = the individual investor would own 1% of the $100M multi-asset SPV or LP Fund entity.

Custom Naming Of Fund Entities

Customize your Master Series LLC fund name (e.g. “Your Parent Fund Name LLC”) or use Finally’s Master Series LLC called “Master Fund I LLC”, where each single-asset SPV investment would be named “Opportunity Name, a Series of Your Parent Fund Name LLC” and each multi-asset SPV investment would be named “Fund I, II, or III Name, a Series of Your Parent Fund Name LLC”. If you create a LP Fund entity, your fund name would be, “Name Fund I, II, or III LP”.

Custom Fund Terms per Multi-Asset SPV or LP Fund Entity

Tailor the management fee and carried interest for the fund strategy you are implementing.

Save Money

The Master Series LLC / Multi-Asset SPV Fund model and LP Fund model is a structure that provides cost savings for fund managers because you don’t need to create a seperate LLC for each investment which would have annual legal maintenance fees per LLC.

Fund Doc Templates

Finally provides fund managers with the fund doc templates for the Master Series LLC, Multi-Asset SPVs, and LP Fund entities, which can then be further customized.

Finally Is A Full Service Fund Admin Platform

![]() KYC/AML

KYC/AML

Finally provides KYC/AML checks for all investors.

![]() Fund Accounting & Taxes / K1s

Fund Accounting & Taxes / K1s

Finally has a dedicated accoutning and tax team that prepares the accounts and taxes / K1s for all your investors across all your investments, which are accessed from with your investor portal.

![]() Management Accounting & Corporate Tax

Management Accounting & Corporate Tax

Finally provides operational management accounting and corportate tax services for the Fund Management LLC entities.

![]() Distributions

Distributions

Finally can manage the distributions to your investors, either on one a time basis or a recurring basis.

![]() Audit Support

Audit Support

Custom quotes can be provided by third party audit partners in Finally’s network.

![]() Legal

Legal

Finally can recommend a trusted legal partner to edit and/or consult with you on your fund documents.

Pricing

Finally provides custom pricing for each Multi-Asset SPV and LP Fund based on the number of investors, number of investments, and total amount of capital.

Deposit

There is a $3,000 deposit per Multi-Asset SPV or an LP Fund + $300 one-time new client set-up fee and the remainder is paid upon the first closing of each Multi-Asset SPV or LP Fund.

Annual Payment For Fund Admin

Finally also offers a customer friendly annual payment model unlike other fund admin service providers which charge 7-10 years upfront. However, if you would prefer to pre-pay for 7-10 years for fund admin services, please let us know and we can provide you with discounted pricing.

Pricing: Multi-Asset SPVs & LP Funds